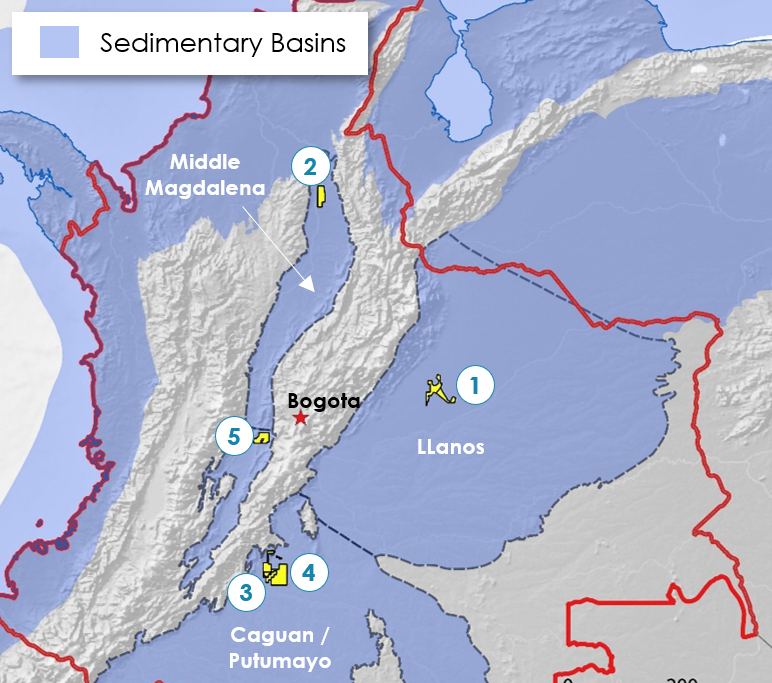

Asset Overview

| Asset | Basin | WI | Net Production (boe/d) | Operator | |

|---|---|---|---|---|---|

| 1 - Core | Tapir | Llanos | 50%* | 2,300 | PetrolCo* |

| 2 - Core | Santa Isabel (Oso Pardo) | MMV | 100% | 130 | ARROW |

| 3 | Alberta | WCSB | 100% | 300 | Arrow & Other |

| 4 | Ombu | Putumayo | 10% | 280 | Emerald |

| TOTAL | 3,000+ |

*Arrow’s beneficial 50% interest in the Tapir block is contingent on the assignment by Ecopetrol.

Colombian Oil & Gas Industry Dynamics

- World commodity pricing exposure to higher Brent oil prices (v. WTI)

- Good access to infrastructure with spare pipeline capacity – no bottlenecks

- Two port facilities in Caribbean provide ample export capacity

- Oil a very important contribution to the country’s exports (30%+) and a government that is very supportive of the oil and gas industry

- Excellent fiscal terms (royalty/tax regime) introduced in 2003/2004 resulted in production nearly doubling to approximately 1.0 MMbbls/d by 2012

- Royalties remain very attractive (8-14% on Arrow properties)

- Recent protests do not change the long-term, stable outlook for Colombia, one of South America’s most fiscally responsible countries